All You Need To Know About Special Income Tax Benefits For Seniors

Samyuktha Vibhu, a Certified Financial Planner (CFP) at ithought Advisory guides you through the special income tax benefits for seniors

In Budget 2021, the Government made a special announcement for senior citizens. This provision may benefit you if:

You are 75 years or older and a resident Indian

Your only source of income is pension.

You earn interest only from the same bank through which you receive the pension. And this is a Specified Bank.

If these conditions are met, you need not file income tax returns. By submitting relevant declarations to the bank, the bank will adjust the TDS. However, if you need to claim refunds, you would still need to file returns.

As we begin a new financial year, senior citizens need to choose a tax regime and identify which avenues they want to invest in to claim those tax benefits.

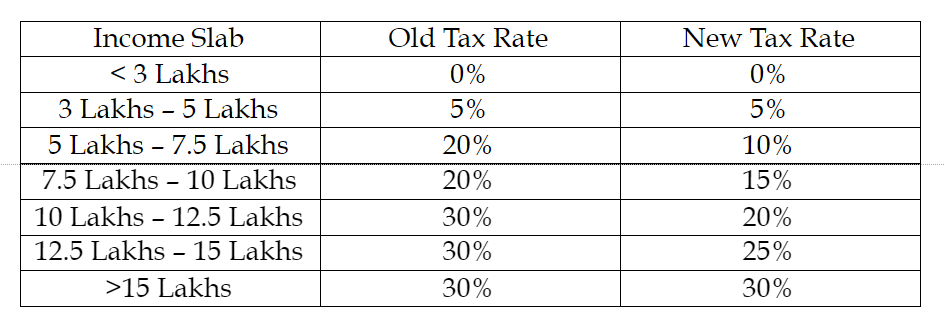

Old Regime Vs New Regime

Seniors need to choose between the old regime and the new regime. The old regime allows citizens to reduce their taxable income through various deductions. The two most common sections for deductions are 80 C (investments) and 80 D (health insurance). The new regime contains lower tax rates, has greater investment flexibility, and is easier to comply with.

Knowing which regime is right for you involves understanding your cash flows, investment preferences, taxable income, eligible deductions and much more. Work with a financial planner or investment adviser to select the right regime.

If you choose the new tax regime, you needn’t worry about making specific investments or expenses.

Investment Options Under The Old Tax Regime

ELSS

In the past, seniors have often stayed away from equity mutual funds deeming them too risky for their retirement corpus. However, the ELSS (Equity Linked Savings Scheme) is a special category of tax saving mutual funds. Investors can save up to Rs. 1.5 Lakhs in an ELSS fund and claim the deduction under Section 80C. What makes ELSS funds particularly attractive for seniors is the low lock-in period. Amongst all tax-saving investments, ELSS has the lowest lock-in of 3 years. Once the lock-in period expires, you can choose to remain invested or redeem your investment.

Returns in ELSS funds are not guaranteed, they are market-linked. Equity returns have the potential to beat inflation in the long run. The capital gains made on an ELSS fund are taxable at 10%.

Investing in ELSS funds is flexible – you can make one-time, ad-hoc, or systematic investments. You can invest with as little as Rs. 1,000. And you can invest in multiple ELSS funds to claim the benefit.

PPF

The Public Provident Fund is an investor favourite. It’s one of the few investments that fall into the EEE category. This means that the investment made is eligible for tax benefits, the income earned is exempt from tax, and the maturity proceeds are also exempt from tax. To keep your PPF account active you must contribute at least Rs. 500 every year for 15 years. You can renew your PPF account for a block of five years on maturity. The maximum contribution in a financial year is Rs. 1.5 Lakhs. Each person can have only one PPF account. The current PPF rate is 7.1%.

SCSS

The Senior Citizens Savings Scheme as the name suggests is an investment exclusively for seniors. It functions like a fixed deposit, where interest is paid out every quarter to the deposit holder. The current interest rate on SCSS is 7.4%. This income is taxable. Seniors can invest between Rs. 1,000 and Rs. 15 Lakhs in the scheme. However, only up to Rs. 1.5 Lakhs is eligible for deduction under Section 80 C. The scheme has a lock-in period of 5 years and can be extended for another 3 years. Compared to other FD rates, the SCSS is quite attractive.

Life Insurance

It is still common for people to choose life insurance policies to claim tax benefits. However, this strategy is completely avoidable for seniors. Post-retirement, the need for life insurance is limited and premiums increase sharply with age. In general, investors should avoid life insurance policies that combine investments and insurance. These products provide inadequate insurance and offer modest returns.

Comments

Post a comment